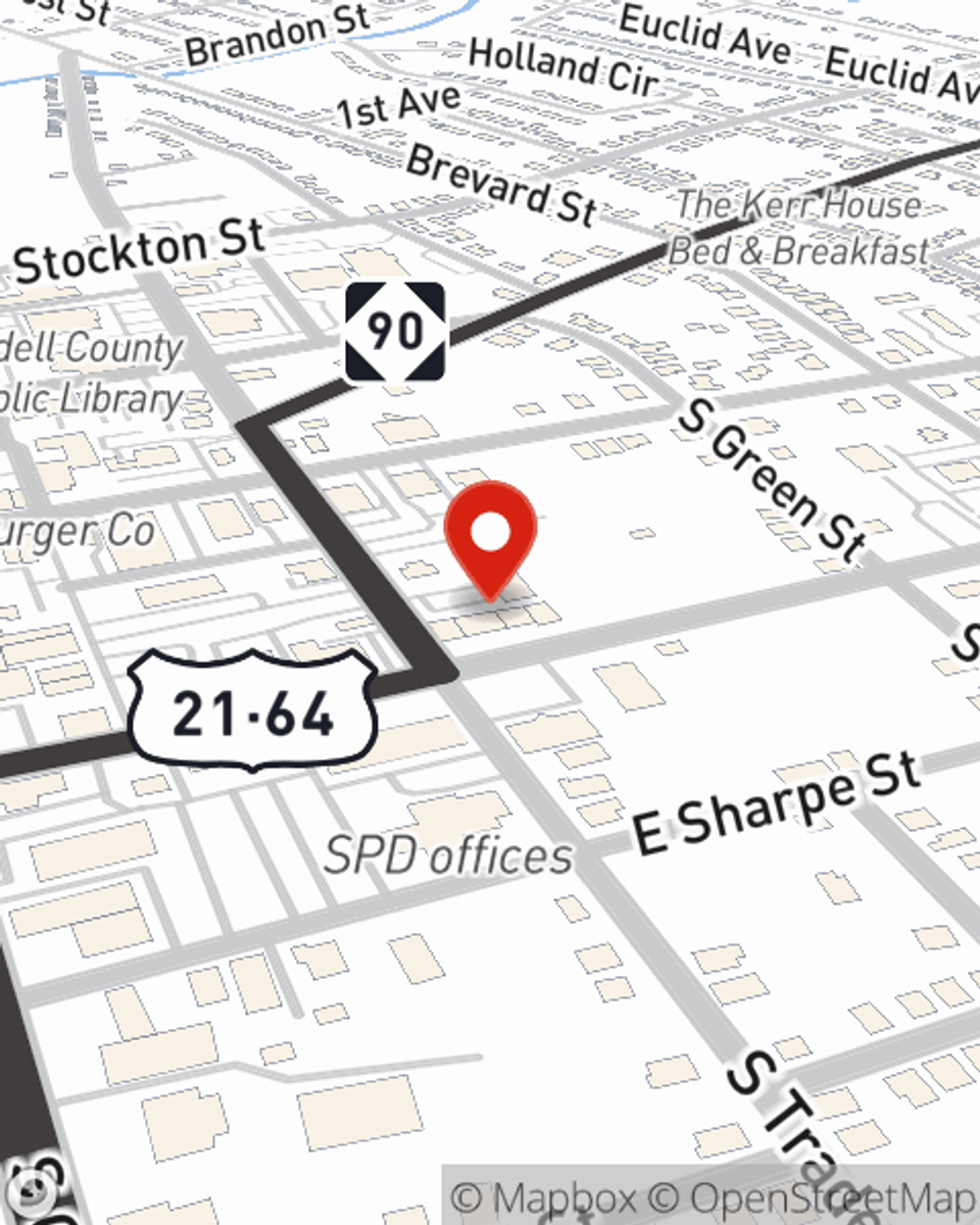

Business Insurance in and around Statesville

Looking for small business insurance coverage?

Insure your business, intentionally

- Statesville

- Troutman

- Hickory

- Mooresville

- Kannapolis

- Concord

- Yadkinville

- Elkin

- Mount Airy

- Winston Salem

- Clemmons

Cost Effective Insurance For Your Business.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes catastrophes like a customer stumbling and falling can happen on your business's property.

Looking for small business insurance coverage?

Insure your business, intentionally

Insurance Designed For Small Business

The unexpected is, well, unexpected, but that doesn't mean you shouldn't be prepared. State Farm has a wide range of coverages, like errors and omissions liability or a surety or fidelity bond, that can be created to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Emilio Lopez can also help you file your claim.

Don’t let concerns about your business stress you out! Visit State Farm agent Emilio Lopez today, and discover how you can benefit from State Farm small business insurance.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Emilio Lopez

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.